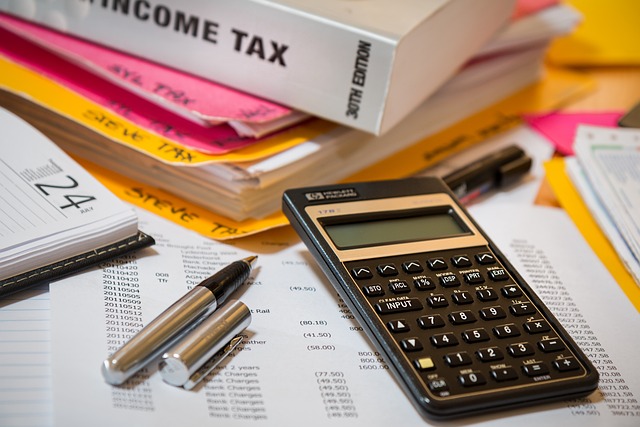

The historical changes in South African Inheritance Tax (IHT), dating back to the 1920s, reflect the country's economic and social development. The tax system has evolved with adjusted rates, exemptions, and criteria to balance wealth redistribution and fiscal sustainability. Calculation involves determining estate value, applying correct tax rates, and considering professional advice. Staying informed about current regulations and avoiding common mistakes is crucial due to tightening IHT rules over time. Key focus areas include accurate asset valuation, exemption awareness, and regular estate plan reviews.

“Unraveling the complexities of inheritance tax in South Africa is essential for both individuals and families. This guide takes you on a journey through the historical perspective of this tax, highlighting key changes over time. We’ll demystify the calculation process, breaking it down into manageable steps. Additionally, we’ll shed light on common mistakes to avoid and offer valuable tips for strategic tax planning. By the end, you’ll be equipped with knowledge to navigate the South African inheritance tax landscape.”

- Understanding Inheritance Tax: A Historical Perspective in South Africa

- Key Factors Influencing Inheritance Tax Calculation

- Step-by-Step Guide to Calculating Inheritance Tax

- Common Mistakes and Tips for Efficient Tax Planning

Understanding Inheritance Tax: A Historical Perspective in South Africa

The concept of inheritance tax in South Africa has evolved significantly over the years, reflecting historical changes in the country’s economic and social landscape. The tax was first introduced in the 1920s as a way to distribute wealth and support the growing needs of post-colonial South Africa. Initially, the focus was on ensuring that wealthy individuals contributed to national development through inheritance levies. However, as the nation progressed, so too did its inheritance tax system, adapting to changing demographics and economic realities.

Over time, various governments have implemented alterations to the tax structure, responding to calls for fairness and equity. Historical changes in South African inheritance tax include shifts in taxation rates, exemptions, and qualifying criteria. These adjustments aim to balance the need for revenue with considerations of social justice, ensuring that inheritance tax remains a relevant and responsive mechanism for wealth redistribution in the nation’s ever-evolving society.

Key Factors Influencing Inheritance Tax Calculation

The calculation of Inheritance Tax (IHT) in South Africa is influenced by several key factors, which have evolved over time due to historical changes in the country’s tax laws. One significant factor is the value of the estate, including all assets and property. The tax is progressive, meaning higher values attract a greater rate of tax. Additionally, the relationship between the deceased and the beneficiary plays a role; closer relationships generally result in lower tax rates or exemptions.

The historical changes in South African IHT reflect global trends and economic shifts. Over the years, there have been adjustments to tax brackets and rates, with recent reforms aiming to balance fairness and fiscal sustainability. Tax laws often adapt to changing societal norms, family structures, and wealth distribution, ensuring that inheritance tax remains relevant and equitable.

Step-by-Step Guide to Calculating Inheritance Tax

Calculating Inheritance Tax in South Africa involves understanding historical changes and a step-by-step process. The tax has evolved over time, with adjustments to rates and exemptions reflecting societal and economic shifts. These historical changes are key to navigating the current system effectively.

To calculate inheritance tax, follow these steps: first, determine the value of the estate, including all assets and liabilities; second, identify applicable exemptions and deductions; third, apply the appropriate tax rate based on the taxable amount; and finally, consult with a professional for advice tailored to your specific circumstances. This method ensures compliance with South African tax laws while considering any historical changes that might impact inheritance tax obligations.

Common Mistakes and Tips for Efficient Tax Planning

Many individuals planning their inheritance often make common mistakes that can impact their tax liabilities. One of the key factors to understand is the historical changes in South African Inheritance Tax, which has evolved over time. In the past, loopholes and exemptions were more prevalent, but these have been gradually tightened by the South African Revenue Service (SARS). This means that what may have been considered a strategic tax-saving measure in previous years might no longer apply today.

To ensure efficient tax planning, it’s crucial to stay updated with the latest regulations and consult professionals who can guide you through the process. Common mistakes include underestimating the value of assets, failing to consider applicable exemptions, and not reviewing your estate plan regularly. By understanding these pitfalls and proactively seeking advice, individuals can navigate inheritance tax compliance more effectively, ensuring their wishes are respected while minimising potential financial burdens for their beneficiaries.

Calculating Inheritance Tax in South Africa involves navigating a complex web of historical changes and current regulations. Understanding these factors, as outlined in this guide, is crucial for efficient tax planning. By grasping the key influences and common pitfalls, individuals can ensure they comply with the law while minimizing their tax burden. Remember that informed decision-making, based on accurate calculations, is the cornerstone of effective inheritance tax management.