The Current Inheritance Tax Rates in South Africa vary based on the relationship between the deceased and beneficiaries, with direct descendants facing higher rates. Understanding exemptions and deductions, influenced by historical changes in tax laws, is crucial for effective Estate Planning Strategies. By leveraging these strategies, individuals can mitigate the Impacts of Inheritance Tax on Beneficiaries and ensure a fair distribution of assets while adhering to tax regulations. Key tactics include structuring assets, making lifetime gifts, and utilizing trusts to protect wealth from taxation and claimants. Staying informed about historical trends is essential for optimal tax planning under continually evolving rates.

“Unraveling the intricacies of inheritance tax in South Africa is crucial for both individuals and families looking to protect their legacy. This article guides you through the current landscape, offering insights into the country’s Current Inheritance Tax Rates and Historical Changes. We delve into practical strategies, including Exemptions, Deductions, and Estate Planning, to minimize tax burdens. Understanding these tactics is essential to mitigating the Impacts on Beneficiaries and ensuring a smooth transfer of assets for future generations.”

- Current Inheritance Tax Rates in South Africa: Understanding the Basics

- Exemptions and Deductions for Inheritance Tax: What You Need to Know

- Estate Planning Strategies for Inheritance Tax: Preparing for the Future

- Impacts of Inheritance Tax on Beneficiaries: How It Affects Families and Assets

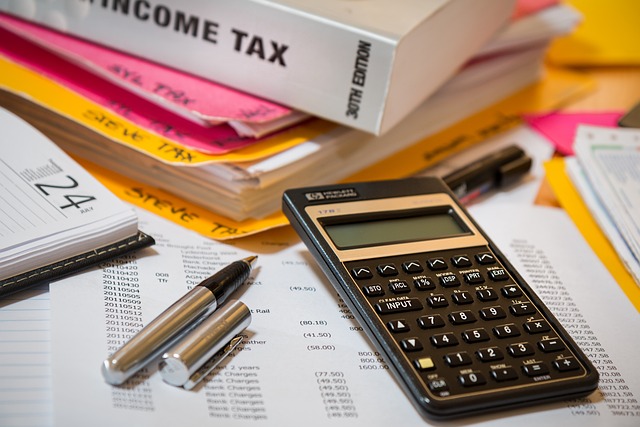

Current Inheritance Tax Rates in South Africa: Understanding the Basics

The Current Inheritance Tax Rates in South Africa form a crucial part of the country’s tax system, impacting the transfer of wealth between individuals. These rates vary based on the relationship between the deceased and the beneficiaries, with closer relations generally facing higher taxes. For instance, direct descendants like children and grandchildren are subject to different rate structures compared to distant relatives or friends named in a will. Understanding these complexities is key when considering Estate Planning Strategies for Inheritance Tax.

Historical Changes in South African Inheritance Tax have reflected shifting societal values and economic landscapes. Over time, the government has implemented various exemptions and deductions for inheritance tax to mitigate its impact on beneficiaries, especially in cases where significant assets are being transferred. These measures aim to balance the collection of taxes with the need to protect the interests of those who stand to inherit, ensuring a fair distribution of wealth while adhering to the country’s tax regulations.

Exemptions and Deductions for Inheritance Tax: What You Need to Know

In South Africa, understanding exemptions and deductions is a crucial aspect of navigating the current inheritance tax rates. The Current Inheritance Tax Rates in South Africa vary based on the value of the estate and the relationship between the deceased and the beneficiaries. For example, direct descendants like children, grandchildren, and spouses are often exempt from certain portions of the tax, while other relatives might qualify for reduced rates. These exemptions and deductions can significantly mitigate the Impacts of Inheritance Tax on Beneficiaries, ensuring that more of the deceased’s estate reaches the intended heirs.

Estate planning strategies play a pivotal role in managing inheritance tax obligations. By employing well-thought-out plans, individuals can leverage available Exemptions and Deductions for Inheritance Tax to their advantage. This may involve structuring assets in specific ways, utilizing lifetime gifts to reduce taxable estate, or choosing the right trusts to protect property from high tax rates. Historically, Historical Changes in South African Inheritance Tax have been influenced by economic shifts and policy updates, reflecting the evolving needs of society. Staying informed about these changes is essential for individuals looking to optimize their inheritance tax planning.

Estate Planning Strategies for Inheritance Tax: Preparing for the Future

As the current inheritance tax rates in South Africa continue to evolve, effective estate planning strategies are essential for individuals looking to protect their assets and minimize potential tax liabilities. By understanding exemptions and deductions for inheritance tax, one can significantly reduce the impacts on beneficiaries. Historically, changes in the South African inheritance tax have reflected shifts in societal values and economic landscapes, underscoring the importance of staying informed.

Estate planning strategies for inheritance tax involve a multifaceted approach. This includes structuring assets in a way that leverages legal exemptions and deductions, such as gift taxes and life insurance proceeds. Additionally, careful consideration should be given to the timing of transfers, taking advantage of lower tax brackets or awaiting changes in legislation. A well-crafted estate plan can also include trusts and other vehicles designed to protect assets from both taxation and potential claimants, ensuring a smoother transition for beneficiaries while preserving wealth.

Impacts of Inheritance Tax on Beneficiaries: How It Affects Families and Assets

The current Inheritance Tax (IHT) rates in South Africa can significantly impact families and the distribution of assets upon a loved one’s passing. This tax is levied on the value of an individual’s estate, including property, investments, and personal possessions, which are passed on to beneficiaries. The impacts extend beyond financial implications; they can cause emotional strain and complicate family dynamics during an already challenging time.

Understanding exemptions and deductions for IHT is crucial in Estate Planning Strategies. Historically, South Africa has witnessed changes in its inheritance tax laws, reflecting shifts in societal values and economic landscapes. By employing legal strategies to minimize the tax burden, families can ensure that their assets are distributed according to their wishes. This involves careful consideration of applicable exemptions, such as personal belongings and certain types of property, as well as utilizing deductions for costs associated with estate administration.

By understanding the current inheritance tax rates in South Africa, utilizing exemptions and deductions, implementing robust estate planning strategies, and considering the historical changes in the tax system, individuals can effectively navigate and mitigate their inheritance tax liabilities. These measures not only ensure compliance with the law but also help to preserve family assets and secure a smoother transition for beneficiaries.